The Trustee of the Wincanton Pension Scheme is making some updates to the investment options in the Defined Contribution (DC) section of the Scheme. These changes are designed to keep your pension savings well-diversified and aligned with long-term goals.

What is changing?

The equity investments in the growth phase of the Cash at Retirement and Income at Retirement Lifestyle Options will be updated. At the moment, these are invested in the BlackRock 30:70 (Currency Hedged) Equity Fund. This will soon be replaced by a new fund called the Wincanton Equity Fund, which will include:

- 95% in the BlackRock Currency Hedged World ESG Equity Tracker Fund

- 5% in the BlackRock Emerging Markets Equity Fund

If you’re in either lifestyle option, this change will happen automatically. You don’t need to do anything unless you want to make a change.

Why are these changes being made?

- Closer alignment with global markets: The new fund reflects a wider spread of global markets, helping to ensure your investments remain well-diversified.

- Sustainability focus: The new fund takes into account environmental, social and governance (ESG) factors when choosing investments, supporting responsible long-term growth.

Will there be any impact on charges?

The annual charge will increase slightly from 0.16% to 0.192%, which the Trustee believes is reasonable for the improved strategy. There may be some transaction costs when the changes are made, but the transfer will be managed in the most cost effective way to keep costs as low as possible.

When will the changes take place?

There is a blackout period taking place from 15 October to 12 December 2025, when you won’t be able to view your account or make changes. Trades are made on 30 October, 13 November, and 2 December 2025.

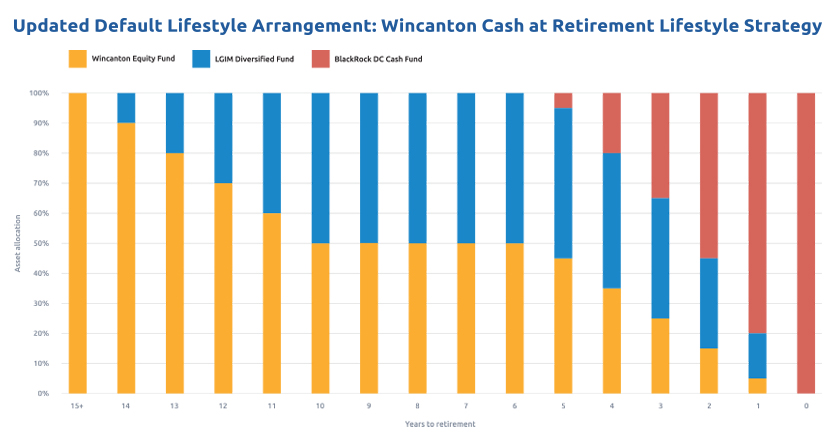

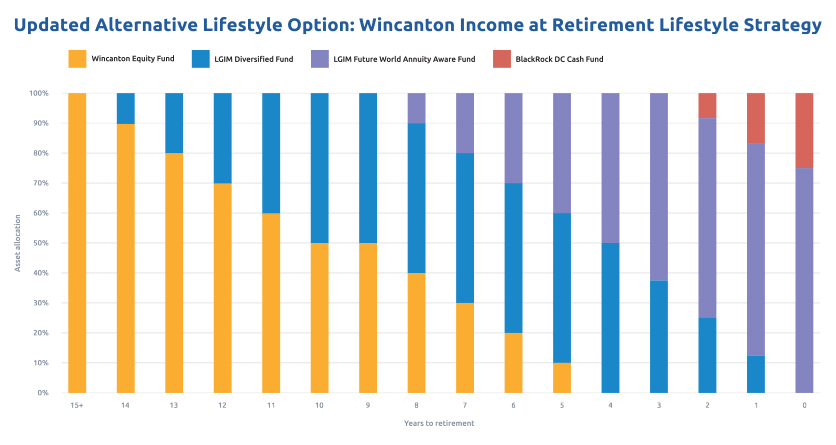

Updated lifestyle strategies

The charts below show how the asset allocation within each lifestyle strategy changes over time as you approach your selected retirement age. These updated glidepaths reflect the replacement of the existing fund with the new blended equity fund and are provided for your reference.

Cash at Retirement Lifestyle Strategy

Income at Retirement Lifestyle Strategy

What do I need to do?

- If you’re happy with the changes, you do not need to do anything.

- If you don’t want the changes to apply to your savings: Contact Capita on 0345 122 2032 or through the online portal.

If you haven’t yet registered for the portal and need help, read the Manage your pension online page.

It’s also important to check that your retirement date reflects your future plans, as lifestyle strategies are based on this date. You can update it by contacting Capita.

How can I get advice?

For help finding a financial adviser, visit MoneyHelper.

Stay alert to pension scams

Don’t respond to cold calls or unsolicited messages about your pension. If you have concerns or you’re not sure about your options speak to the Scheme Administrator or visit The Pensions Regulator’s website for more information.